1. Fed's decision to cut interest rates by 2 yards in one fell swoop to protect the economy, and another 2 yards by the end of the year.

2. The Central Bank freezes interest rates for 2 consecutive times, raises the standard by 1 yard, and imposes 4 measures for the seventh wave of housing market control.

3. Corporate asset revitalization Commercial real estate transactions exceeded $100 billion in the first eight months of the year

4. Pre-sale transactions at a record low for the month of May.

5. Storefronts are heating up! H1 Taipei Billion Dollar Store Transaction Volume Doubled This Year

6. Kon Tac wins the "Shun Yee Children's Home B2" and spends $7.6 billion to build a 26-storey twin-tower building.

7. Chang Gung Wellness Village, the queue erupted.

1. Fed's decision to cut interest rates by 2 yards in one fell swoop to protect the economy, and another 2 yards by the end of the year.

2024.09.19 Economic Daily News I Editorial Liao Yuling/Integration of Foreign Newspapers

The U.S. Federal Reserve (Fed) announced at 2 p.m. EST (2 a.m. Taipei 19) that the benchmark interest rate would come in at 4.75-5.0%, the Fed's first rate cut in four years, and CNBC described it as a positive start to its cycle of rate cuts to defend the economy.

With weakness in the US job market and slowing inflation, the FOMC's decision to cut interest rates by two yards at a time confirmed that the market's expectations, which had only shifted in the last week, were correct.

CNBC reported that, minus the emergency rate cut during the new crown epidemic, the last time the FOMC cut interest rates by 2 yards in one fell swoop was during the global financial tsunami in 2008.

According to the "Point Chart", policymakers believe that interest rates will be cut by another 2 yards before the end of this year to 4.25%~4.5%, which is close to the market's expectation.

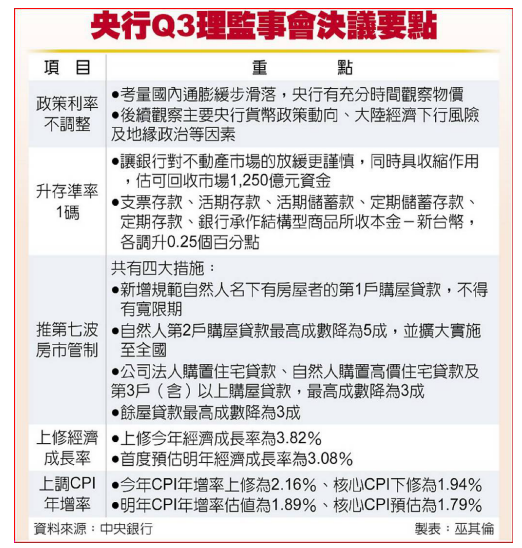

2. The central bank freezes interest rates for 2 consecutive times, raises the standard by 1 yard, and adds 4 measures for the seventh wave of housing market control.

2024.09.19 Free Times I By Chen Mei-ying/Taipei

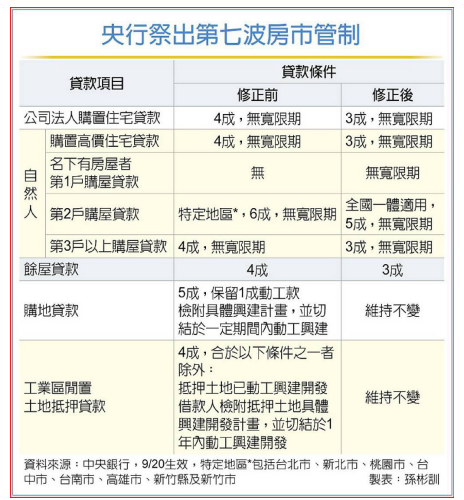

Despite the first interest rate cut by the Federal Reserve Board in 4 years, Taiwan's central bank is still determined to go its own way. Due to the high concentration of real estate loans in banks and the central bank's concern that the concentration of too many credit resources in real estate may affect financial stability, the central bank raised the deposit reserve ratio by 1 yard (0.25 percentage points) in June and then raised it by 1 yard in September at the supervisory meeting and increased the control of the 7th wave of the housing market by eliminating the grace period for homebuyers who have real estate under their names. The grace period was abolished for home buyers with properties in their names, and the loan-to-value ratio for second household loans for natural persons was lowered to 50% and extended to the whole country, while the maximum loan-to-value ratio for corporate purchases and balance loans was lowered to 30%.

The Central Bank has amended the "Regulations of the Central Bank on Financial Institutions' Real Estate Mortgage Loan Business", which came into effect on September 20 this year. The latest amendments include the following four items, including.

1. The new regulation stipulates that no grace period is allowed for the 1st home purchase loan of a natural person who owns a home in his/her name.

2. the maximum loan-to-value ratio for 2nd home purchase loans for natural persons is lowered from 60% to 50%, and the implementation area is extended to the whole country.

3. the maximum loan-to-value ratio for residential purchase loans for corporate entities, high-priced residential purchase loans for natural persons, and loans for the purchase of three or more homes (inclusive) will be reduced from 40% to 30%.

4. The maximum loan-to-value ratio for residual housing loans is reduced from 40% to 30%.

Regarding the Central Bank's new regulation that no grace period is allowed for a natural person with a house in his/her name for a 1st home purchase loan, housing experts explained that, in general, the current grace period for a mortgage loan (interest only, no repayment of principal) is 2 years, and the maximum length of the Youth Housing Loan Program is 5 years. The central bank's new rule is that a natural person who has a house in his name (inheritance, joint ownership with others, or a paid-up mortgage are all examples) will not have a grace period from September 20 for his 1st home loan.

The central bank's seventh wave of anti-speculation measures and the overall revision of the loan-to-value ratio for home purchase loans were mainly due to the rebound in housing market transactions and the expansion of housing price inflation since the second half of last year, which drove the annual growth rate of residential purchase loans to 11% at the end of August, the highest since May 2006, and the construction loans to 5% at the end of August, the highest among all banks. In addition, the annual growth rate of construction loans also rebounded to 5% at the end of August, while the ratio of real estate loans to total lending (concentration of real estate loans) among all banks was high at 37.5% at the end of August this year, close to the historical high of 37.9%.

From August 12 to 21, the Central Bank invited 34 local banks to a seminar and, by way of moral suasion, asked them to propose specific and quantitative improvement plans for self-managed real estate loans in the coming year without affecting the demand for home purchase financing of people without owner-occupied residences, as well as the funds needed by the industry to promote urban renewal, redevelopment of the elderly at risk, social housing, and other uses in line with the government's policies, as well as the funds needed by corporations to purchase their own factories and offices. To improve the situation of over-concentration of credit resources in real estate loans. In the future, the Central Bank will regularly review the effectiveness of the improvement program and urge the banks to implement the improvement program through on-site inspections.

In order to further strengthen the management of banks' credit resources, curb speculation and hoarding in the housing market, and guide credit resources to prioritize the provision of housing loans to people who do not own their own homes, the "Regulations on the Central Bank's Real Estate Mortgage Loan Businesses for Financial Institutions" were amended and have been put into effect since September 20, 2012, and the "Regulations on the Central Bank's Real Estate Mortgage Loan Businesses for Financial Institutions" have been amended and put into force.

3. Revitalization of corporate assets Commercial real estate transactions exceeded $100 billion in the first eight months.

2024.09.19 Business Times I Reporter Guo & Tian/Reporting

Enterprises' awareness of diversified asset allocation is on the rise, and they are optimistic about the development of the commercial market to accelerate asset revitalization. According to the statistics of Xinyi Global Assets, under the injection of two big cases of tens of billions of dollars, such as the Hibiscus Building and Chun Chong's Nanking Plant 4, the transaction amount of commercial real estate in the first eight months of the year exceeded hundreds of billions of dollars, reaching 116.2 billion dollars, with a yearly increase of 47%.

Statistics show that the value of commercial real estate transactions has exceeded $100 billion in the past five years, with $177.7 billion in 2022 being the highest, before falling back to $133.5 billion last year.

This year, companies such as Yihua Industry, Changchun Resin, I-Chiun Precision, Delta Electronics and IGS have invested more than $2 billion in the purchase of commercial real estate, and there were 26 commercial real estate transactions with a total value of more than $1 billion for listed companies, indicating that the market for commercial real estate is still very active.

Among all types of commercial real estate, industrial real estate, which accounts for more than half of the total, saw the highest growth of 184%, mainly due to the increase in demand for industrial self-use and factory expansion, and the activation of the revitalization strategy by corporations taking stock of idle assets to improve asset efficiency through disposal, sale and leaseback, redevelopment, and leasing, etc. The release of good goods to the market will naturally attract buyers with factory expansion needs, such as the sale of the four Nanking plants to TSMC by Qunitronics for a total of $17.1 billion. For example, Chun Chong Optoelectronics sold four factories in Nanko to TSMC for $17.1 billion, and AUO disposed of part of its Tainan and Zhongke Houli factories for a total of $8.1 billion, with Micron, a major memory manufacturer, as the buyer.

Mr. Lin Sanzhi, General Manager of Xinyi Global Assets, said that revitalization of assets has a positive impact on both the enterprise itself and the industry as a whole. Re-planning, trading and development of idle assets can enhance the efficiency of real estate utilization. Sellers can use the disposed capital to optimize the company's financial structure, or apply it to research and development of new technologies to support the company's sustainable development, which will enable the company to be more resilient in the face of various changes in the financial market.

For buyers, acquiring commercial real estate that meets their needs can accelerate the deployment of strategic locations and supply chains, boost production capacity, and improve the company's operational efficiency.

Secondly, enterprises strategically dispose of idle assets and also seek partners, not only focusing on commercial real estate transactions with buyers at the moment, but also hoping to have more cooperative interactions with buyers from a long-term perspective, and to form business partnerships to create multiplier benefits.

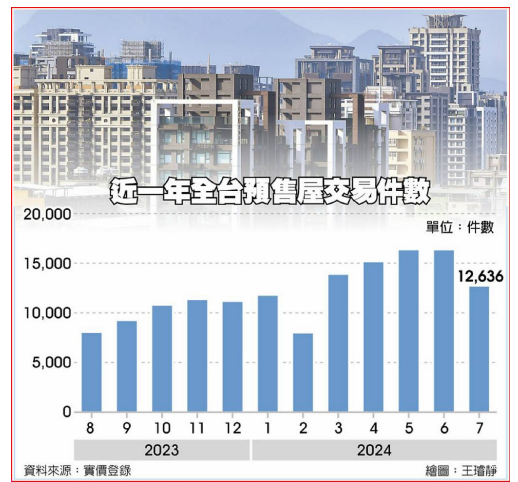

4. Pre-sale transactions at a record low in May.

2024.09.17 Business Times I Reporter Guo & Tian/Reporting

The stock market's high correction has impacted confidence in the housing market. According to the latest pre-sale price disclosure, the number of pre-sale transactions in Taiwan in July was 12,600, a five-month low and a 22% monthly decrease. According to the analysis of real estate agents, the fermentation of mortgage chaos has also affected the pre-sale market, and pre-sale buyers who are not first-time buyers are beginning to worry about the future delivery of their homes in terms of underwriting, so we can continue to observe the volume of transactions in the pre-sale market in August and September to see if it will have an impact on the pre-sale market.

Generally speaking, if the monthly transaction volume of Taiwan's pre-sale housing exceeds 10,000 units, it means that the boom is hot, and the monthly transaction volume in the first half of 2022-2023 is mostly under 10,000 units, but after the amendment to the Equalization of Land Rights Act came into effect in July last year, the volume of Taiwan's pre-sale housing transaction volume has grown rapidly in line with the hot boom, with more than 10,000 units in October last year, 13,000 units in March this year, and an even more rapid growth of 16,000 units in May and June. In May and June, there were even 16,000 transactions.

However, compared with the month-on-month growth in the number of transactions over the past year, July this year saw the first cooling down in nearly a year, with the number of transactions falling below 13,000 in a single month, and the enthusiasm for buying returned to the level of the first quarter of this year.

The project manager of Xinyi Housing Enterprise Research Office, Tseng Jingde, said that in late July, the banks tightened the money, the mortgage shortage began to ferment, although the pre-sale to the delivery of the house there is still a period of time, but in addition to the purchase of pre-sale cases for general self-use needs, there are also buyers of home ownership, pre-sale and delivery of the house is not as easy as before the mortgage, the buyer of the non-first-time buyer will be worried about whether the delivery of the house in the future will encounter similar problems, the market is usually more panicked in the early stage of the mortgage crunch event. The market is usually more panicky at the beginning of a mortgage crunch.

In addition to the good conditions of the case of the first half of the hot sales, new launches can not keep up with the July stock market after the record highs of a sharp downturn, have affected the July presale market, there is a significant drop in temperature. At present, some cases have been rumored to reduce the number of people, coupled with a wave of correction of the construction stock index, the first half of the housing market has passed, the future of the pre-sale market may return to the atmosphere of rational purchase of homes.

Compared to June, when the housing market was at its peak, the number of pre-sale transactions in major metropolitan areas across Taiwan dropped significantly in July, with Taichung falling below 3,000, New Taipei City and Kaohsiung below 2,000, and Tainan below the 1,000 mark.

In terms of the magnitude of the decrease, Taipei City, New Taipei City, respectively, a monthly decrease of 38%, 27%, Hsinchu County, a monthly decrease of 39%, the largest reduction in the metropolitan areas, Taichung, Tainan, Kaohsiung, monthly reduction of 2 to 3%, only Taoyuan transactions remained relatively stable, a monthly decrease of only 3%.

5. Storefronts are heating up! This year's H1 Taipei Billion Dollar Store Transaction Volume Doubles

2024.09.18 Business Times I Reporter Guo & Tian/Reporting

Taipei City, New Life North Road, Section 3, Lane, Shuangcheng Street, near the business district of a one-story house, the past for the former residence of the Flying Tiger Generals, has been listed by the Ministry of Culture as a historical building, by the characteristics of the private chef operation in the lease, according to the real price of the registration shows that in June this year, a natural person to 125 million yuan, bought about 188 ping of the 1st floor to 2nd floor with a lease store, so that the new buyer directly as the current landlord.

Taiwan Housing Zhongshan Minsheng franchisee owner Hsiao You-Chien analyzed that the store is close to the MRT Zhongshan Elementary School Station, and nearby is the Shuangcheng Street shopping district and the Ching Guang shopping district, which has a certain clientele. However, the store is located in an alleyway, and although it is not in a proper shopping district, the building was originally built as a dormitory for high-ranking officers in the late 1940s, and it was rumored to have once been the home of Flying Tiger Generals Chen Nade and Chen Hsiang-mei's husband and wife, and the architectural design was in a Chinese and Western style. The building was renovated and rebuilt, and then leased to the catering industry, with specialties as the main cuisine. The monthly rent was $281,000 for the first three years, and the rent was adjusted to $287,000 per month from the fourth to the fifth year of the lease, and the gross reporting rate of the store was 2.7-2.76%, which was quite impressive.

Taiwan Housing Group Trend Center CEO Zhang Xulan said, the epidemic after the outbreak of national travel, get-together demand is also very hot, due to the increase in acceptance of high-priced consumer food and beverage in recent years, the demand for food and beverage is becoming more and more demanding, not only the cooking, service, decoration should be good, if the restaurant has a topicality, it can be more through the community to disseminate word-of-mouth, so a good location, or special architectural space, there is a story of the storefront, will attract the operation of high-priced restaurant owners, and with the lease sale can also attract the attention of long-term buyers. Therefore, a good location or a special architectural space with a story can attract high-priced restaurant owners, and selling with a lease can also attract the attention of long-term property buyers.

Taiwan Housing Group Trend Center for further statistics, in the past two years, Taipei City, the billion dollar storefront transactions, and the first half of last year was only 9, the average unit price of $1.248 million, Zhongshan District, the hottest transactions, there are 4; and the first half of this year has accumulated 17, the average unit price of storefront 1.816 million, which is also in the Daan District, from last year's zero transactions, this year, there are 9 hundred million dollar storefront transactions, to become a high-priced storefronts The Daan District has become a hot area for high-priced storefronts.

Zhang Xulan analysis, Daan District store due to the high unit price of the total price, the past few years, few transactions, but with the opening of the Dome at the end of last year, activities and events often attract tens of thousands of people, driving the recovery of the business district, the surrounding retail and food and beverage consumption opportunities are also active, so that the East District store transactions this year, there are signs of a significant rebound.

The first building economic research center, deputy manager Zhang Lingyu pointed out that, for the investment in storefront landlords, the past Taipei City, most of the storefront rate of return to 2% for the investment criteria, but in recent years, with the gradual increase in lending rates, rental income profits are also relatively compressed, the rate of return of less than 3% of the commercial real estate, I am afraid that only to level the amount of the loan, so many storefront lease contracts, will set out the regular rent increase, and The ability of well-known brands or chain operators to operate on a stable, long-term basis makes them even more attractive to new buyers."

6. Koon Teck wins the "Shun Yee Children's Home B2 Public Office" and spends $7.6 billion to build a 26-storey twin-tower building.

2024.09.16 Free Times I By Zhu Yu-chiu / Taipei, Taiwan

The "Yifu B2 Public Office Urban Renewal Project" in Xinyi District, Taipei City, has recently completed the comprehensive evaluation of the investors, and finally, Kanton Construction was awarded the most favorable applicant status. The project will be based on the theme of fashionable design and diversified integration, with the planning of a 26-story residential and office building and a 20-story residential building, and the total project investment is about NT$7,615 million, and the signing of the contract will be completed by the end of this year, and the project will be completed in 2031.

"Located in the Xinyi District of Taipei City, the Xinyi Children's Life B2 Project is only 350 meters from the MRT City Hall Station, with a total site area of 2,450 ping, and is zoned for a third type of residential area. Based on the market survey and urban regeneration plan, the residential and shared office space is planned as "work-life integration".

TPD said it will work together with Panjee Associates Architects to create a seed base for fashion design by combining residential and new innovations with the core concept of "Our Island", which echoes the vision of the apparel industry in the Taiwufenpu area.

According to the National Residence Center, the residential and office buildings will have industrial seed bases, workshop spaces, flexible expansion of office units, and rental housing with design styles, with shared spaces inside the buildings for the use of community residents; the lower floors of the residential buildings will also have stores, childcare centers, and sheltered workshops, which will make the local living functions more complete, meet the childcare needs of young families, and realize the community's shared, diversified, and inclusive living. Realizing a shared, diversified, and inclusive life in the community

Field.

The structure of this project is made of SRC reinforced concrete with 9×9 meter modular units, which not only enhances the efficiency and flexibility of space usage, but also ensures the quality, efficiency, and safety of the project. The construction project introduces pre-cast methods, using aluminum formwork and recycled building materials to reduce construction waste, and conducts overall planning in a sustainable manner, using intensive greening and carbon sequestration to cool the city and enhance building energy efficiency to reduce carbon emissions, with the goal of obtaining certifications such as the Diamond Level for Green Buildings, Gold Level for Smart Buildings, 1^+ Level for Energy Efficiency in New Construction, and Seismic Labeling.

In order to continue the development of the local apparel industry in Taiwufenpu, TPD will also join hands with MUJI to establish a social enterprise called "Good job center", which is expected to inject angel funds to operate a seed base to incubate the local fashion design industry. In terms of community life, TPD will invite staff to reside in the village and organize a variety of arts and cultural activities and design classes to enhance the vitality of the community. KDRC will adopt the green space of the neighboring park and use public art to recreate the image of the local historical canal, creating a new open space.

7. Chang Gung Health Village: The queue erupted.

2024.09.17 Economic Daily News I By Hsieh Po-Hung / Taipei, Taiwan

Formosa Plastics Group founder Wang Yongqing 20 years ago founded the Changgeng Health Culture Village, this year is expected to turn a loss into a profit. Changgeng health culture village director Du Suzhen said, by the post-war baby boom retirement impact, coupled with changes in national concepts, the current intention to stay in the Changgeng health village queuing wave of people exploded, and now accepts 250 applications per month to move in, the total number of people 1,352 people to move in, there are 2,500 people waiting to move in the queue, the waiting time of up to one and a half years.

Changgeng Health Culture Village was established in January 2005, next January will be 20 years, when Wang Yongqing to provide 34 hectares of land in the form of free donations to provide health village construction, although the land is zero cost, but the hardware construction and related services and facilities invested 8 billion yuan. After years of promotion, it is understood that the current annual expenditure is about $400 million and the income has reached more than $300 million, and the goal of the Village is expected to turn from a deficit to a profit this year.

When Chang Gung Health Village was founded, Y.C. Wang wanted to play the role of a research and demonstration area for the aging industry, so he opened up the Chang Gung medical system and the innovative technologies and products developed by outside companies to be tried out in the village, and then promoted to the entire market of the aging industry after a successful trial. Through the Medical Development Center, the Formosa Plastics Group also conducts innovative medical data collection and research in the Village, in anticipation of creating tens of billions of dollars in market opportunities in the future.

Du Suzhen explained, Changgeng health village total planning A, B, C three buildings, in addition to the B building has not yet begun construction, A building 716 households have been full, C building so far has been 420 households. At present, the village has a total of 1,111 households, 1,352 elderly people, but there are still more than 2,500 people in the queue, if the village accepts 250 applications per month, the waiting time is up to one and a half years.

In order to accommodate the increasing demand for silver-haired seniors, under the planning of Wang Rui Hui, Chairman of Chang Gung Medical Corporation, Building C will continue to be expanded for three years from this year onwards, with 133 units to be added in June this year and another 98 units next year, until 2026, when a total of 406 new units will be added.

Du Suzhen said, Changgeng Health Village was established, due to the location in the remote location of Linkou, the concept of living in the village is still not popular among the Chinese, until recent years due to the post-war baby boom retired more and more people, the concept of gradual change, especially after the outbreak of the epidemic, the situation from the early years of the panhandle, to the current difficult to find a person, "very admirable founders 20 years ago to have the foresight".

Professional office design, inspire your unlimited possibilities Ins

Project Development l Interior Design

We're here to inspire your workplace.